Last updated on August 13th, 2023 at 10:31 am

There are two kinds of flexible spending accounts (FSA) that can greatly help reduce your taxable income: a healthcare FSA and a dependent care FSA. Both are very beneficial to families with small children!

A healthcare FSA can be used to pay for co-payments, co-insurance, deductibles, medical bills, dental care, eye care, prescriptions, and some over the counter medications and products. Twiniversity recommends that every family expecting multiples take out an FSA if their employer offers it. You get to elect how much money you want on your debit card (up to $2,550), starting January 1st or within 30 days after your twins are born. Their birth is considered a “life event” and you can make changes to all of your employee benefits at this time. The FSA provider loads up your card with the full amount to use as you need it. The total you elect is taken little by little out of every paycheck over the course of the year. It’s like getting an interest-free loan for medical expenses that you pay back over a year. This was a must-have when my twins were born! We blew through our elected $1,500 within the first few months, thanks to hospital bills, baby helmets, prescriptions, etc. Expect the unexpected and take out more than you think you’ll need. All of those doctor visit co-pays (x2 if you’re bringing both twins in at the same time!) really add up and you’ll be using it up in no time.

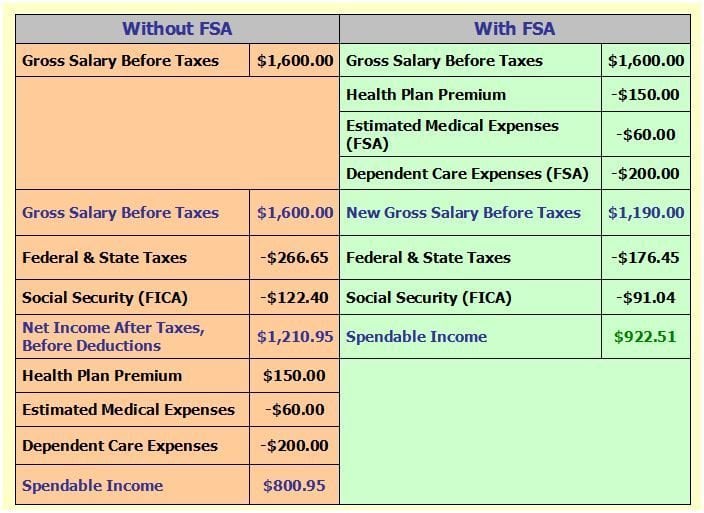

A dependent care FSA is a great way to pay dependent care expenses that occur while you are at work, such as the cost of a nanny, day care, before- or after-school care, day camp, care for the disabled, and so much more. This will help to lower your taxable income. Here’s how it works:

- You direct part of your before-tax pay into a special account to help pay work-related dependent care costs

- You can use your account throughout the year to help pay for eligible expenses

- Your expense must be for the purpose of allowing you and, if married, your spouse to be employed

So you may be wondering what exactly is covered by the healthcare FSA…

Potentially Eligible Medical Expenses

This list was posted in March 2016. Always double check with your FSA provider to determine if an expense is eligible, as rules tend to change annually. Eligible items can vary by employer, so check the specifics of your particular FSA plan.

- Acupuncture

- Alcoholism treatment

- Ambulance

- Artificial limb

- Autoette/Wheelchair

- Bandages

- Birth control pills

- Braille books and magazines

- Breast reconstruction surgery

- Chiropractor

- Christian Science Practitioner

- Crutches

- Diagnostic services

- Disabled dependent medical care

- Drug addiction treatment

- Drugs and medicines (prescription & OTC eligible for Health Care FSA)

- Fertility treatment

- Guide dog or other service animal

- Hearing aids

- Home care

- Hospital services

- Laboratory fees

- Lead-based paint removal

- Lodging essential to medical care

- Maternity care & related services

- Meals for inpatients

- Medical information plan (fees to maintain medical info in databank for your care)

- Medical services (e.g., physician, surgeon, specialist)

- Mentally disabled (special home)

- Nursing home

- Nursing services

- Operations

- Organ donor’s medical expenses & transportation

- Osteopath

- Oxygen

- Prosthesis

- Psychiatric care

- Psychoanalysis

- Psychologist

- Special education

- Sterilization

- Stop-smoking program

- Surgery

- Telephone for hearing impaired

- Television adapted for hearing impaired

- Therapy

- Transplants

- Transportation essential to medical care

- Vasectomy

- Weight-loss program

- Wig to replace hair lost to disease

- X-ray

Potentially Eligible Prescription Medication Care Expenses

You can use your Flexible Spending Account (FSA) dollars to pay out-of-pocket expenses for prescription drug co-payments and co-insurance. Please refer to the specifics of your particular FSA plan, as eligible items can vary by employer.

Potentially Eligible Eye Care Expenses

- Contact Lenses

- Eyeglasses

- Optometrist

- Prescription Sunglasses

- Eye Examinations

- Eye Surgery (e.g. LASIK)

Potentially Eligible Over-the-Counter Medication Expenses without a Prescription

(As of Jan. 1, 2011)

- Band Aids

- Birth Control

- Braces & Support

- Contact Lens Supplies

- Denture Adhesives

- Diagnostic Tests & Monitors

- Elastic Bandages & Wraps

- First Aid Supplies

- Insulin & Diabetic Supplies

- Ostomy Products

- Reading Glasses

- Wheelchairs, Walkers, Canes

Potentially Eligible Dental Care Expenses

- Artificial teeth

- Dental treatment

Potentially Eligible Over-the-Counter Medication Expenses WITH a Prescription

(As of Jan. 1, 2011)

- Acid Controllers

- Allergy & Sinus

- Antibiotic Product

- Antidiarrheal

- Baby Rash Ointment

- Cold Sore Medicines

- Cough, Cold & Flu Medicine

- Digestive Aids

- Laxatives

- Motion Sickness

- Pain Relief

- Respiratory Treatments

Potentially INELIGIBLE Health Care Expenses

The following products and services, within the health care and Over-the-Counter medication categories, are NOT eligible for Flexible Spending Account (FSA) savings.

- Baby-sitting, Childcare, and Nursing Services for a Normal, Healthy Baby

- Household Help

- Illegal Operations and Treatments

- Insurance Premiums (other than specifically for health insurance)

- Maternity Clothes

- Medical Savings Account (MSA)/Health Saving

- Account (HSA) Contributions

- Nutritional Supplements

- Personal Use Items

- Swimming Lessons

- Teeth Whitening

- Veterinary Fees

- Weight-Loss Program not part of specific disease treatment

Ineligible Over-the-Counter Products

- Aromatherapy

- Baby Products (e.g., Bottles, Wipes, Baby Oil)

- Breast Enhancements

- Cosmetic Products (e.g., Makeup, Perfumes)

- Dental Products (e.g., Toothbrush, Toothpaste, Dental Floss)

- Dietary/Nutritional Supplements (e.g., Ensure®, Glucerna®, Slimfast®)

- Feminine Care (e.g., Tampons)

- Herbal Supplements

- Sun Tanning Products

- Toiletries (e.g., Deodorant, Shampoo, ChapStick®)

- Vitamins (for General Health/Routine Use)

Click here to shop FSA Eligible Products on the FSA store.

Are You a New Twin Parent?

Check out Natalie Diaz’s book:

“What To Do When You’re Having Two

The Twin Survival Guide From Pregnancy Through the First Year”

In What to Do When You’re Having Two: The Twins Survival Guide from Pregnancy Through the First Year, national twins guru and founder of Twiniversity (and twin mom herself!) Natalie Diaz provides a no-holds-barred resource about life with twins, from pregnancy and birth all the way through your duo’s first year of life.

Accessible and informative, What to Do When You’re Having Two

is the must-have manual for all parents of twins.

Have you taken your expecting twins class yet? We offer a great class on demand so you can take it on your own schedule! There are so many video modules covering everything from your twins’ baby registry to your first week at home with twins! Sign up today to get started before your twins arrive.

Need some twin parent friends? Get the support you need with a Twiniversity Membership. Benefits include a monthly twin parent club meeting on Zoom, access to a private Facebook group just for twin parents, and a video library of twin parenting lessons. Visit Twiniversity.com/membership to join today!

Twiniversity is the #1 source for parents of

multiples, and we are growing faster every day!

Find us all over the web:

Or contact us by email at community@twiniversity.com